To learn how to trade Indexes, you first need to understand what an index is.

In the stock market, an index is a static measure of the performance of multiple stocks, not just one. It is a visual representation of a specific portion of the stock market. This visualization makes it easier for traders to monitor changes in the market as a whole or in a specific segment. Of course, not all companies' stocks can form an index. These companies need to meet a number of requirements, including market capitalization, weighting, and individual stocks based on their market capitalization. The total value of the index is calculated using the combined value of the selected stocks. The S&P 500, Nasdaq Composite and Dow Jones Industrial Average are examples of some of the best known Indexes.

Why is learning how to trade Indexes a good idea?

After understanding what Indexes are, we can see the main reasons for choosing to learn how to trade Indexes.

01. Indexes Show a Continuing Trend

The movement of an index market is influenced by the underlying stocks that make up the index itself. Stocks in the same sector usually trend in the same direction. For example, in a bull market, an index that is heavily weighted to a particular sector usually responds accordingly and becomes more predictable.

02. Trading Indexes helps reduce risk

With Indexes, you can diversify your portfolio and thereby reduce risk. Indexes are inherently diverse because they are made up of different stocks. As such, they provide investors with exposure to multiple businesses.

03. Indexes are easier to analyze than individual stocks

Indexes are composed of a variety of stocks. Hence, it provides traders with a broad picture of the market and enables them to analyze market trends and performance more comprehensively.

04. Trading Indexes can bring promising returns

Like the stocks they are composed of, the prices of Indexes fluctuate and are affected by several factors. However, some of these Indexes have produced good returns over the long term. While index funds don't always make money every year, on average they have done well in the past.

What are the most traded Indexes?

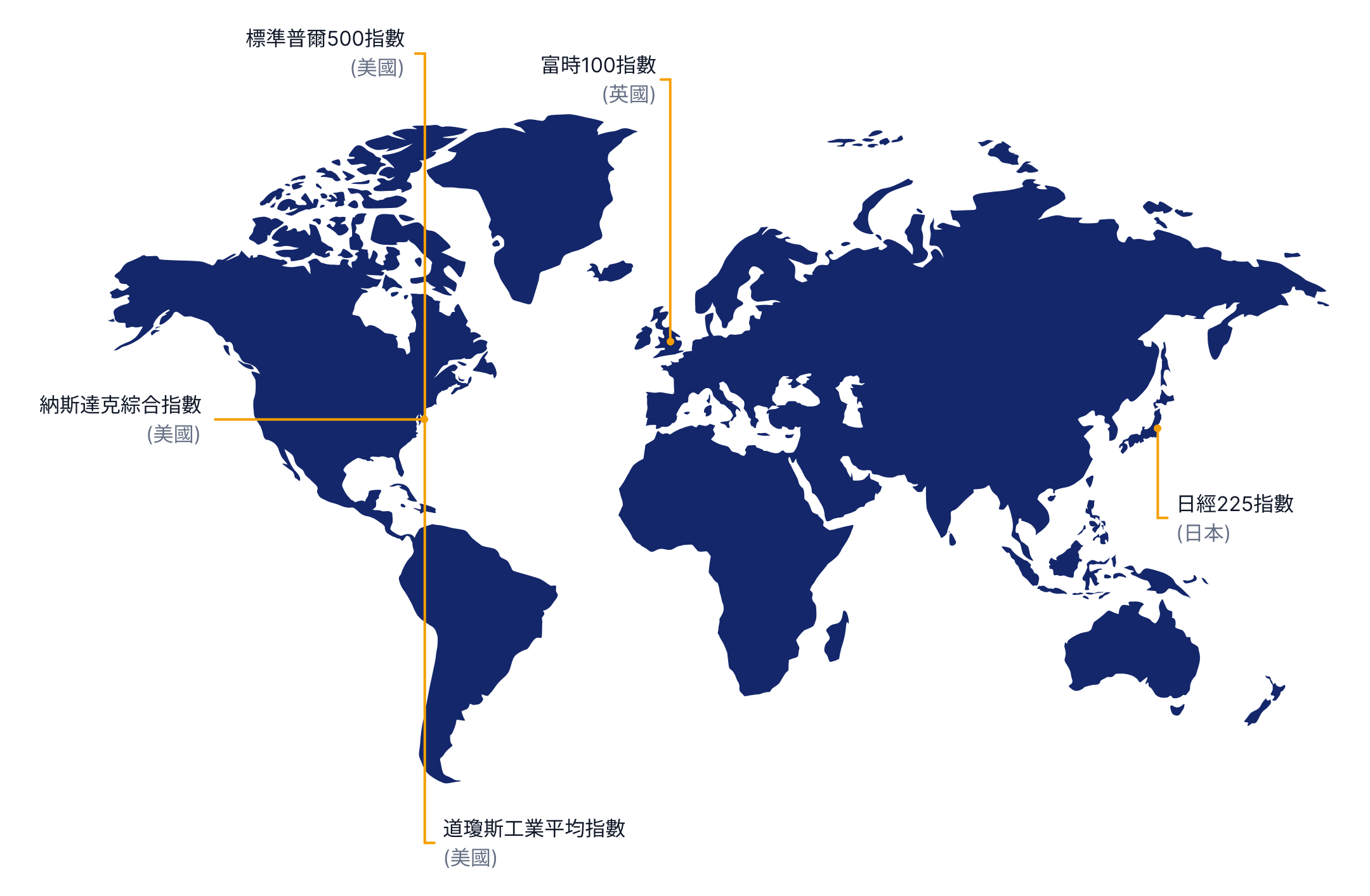

For those interested in learning how to trade Indexes, it's helpful to know the most commonly traded Indexes:

01. S&P 500

It is one of the main indicators of the U.S. stock market, tracking the performance of the 500 largest U.S. companies in various industries.

02. Nasdaq Composite Index (US)

This index focuses on technology companies and tracks the performance of about 3,000 or more companies listed on the Nasdaq stock exchange.

03. Dow Jones Industrial Average (US)

The Dow Jones Industrial Average (US) is one of the world's oldest and most popular Indexes, measuring the performance of 30 blue-chip US companies.

04. Nikkei 225 Index (Japan)

Now, this is the main index of the Tokyo Stock Exchange. It tracks the performance of Japan's top 225 companies.

05. FTSE 100 (UK)

The main index of the London Stock Exchange, the FTSE 100 (UK) measures the performance of the country's 100 largest listed companies.

How to learn how to trade Indexes?

When it comes to trading Indexes, there are a few steps to follow. First, you need to choose your preferred way of trading Indexes and then you can create an account to start your index trading journey. After choosing which index you want to trade, decide whether you want to go long or short. Once you've made your decision, you should set up stop and limit orders. Below are more details on each step:

01. Choose your preferred index trading method

There are several ways to trade and invest in Indexes, such as:

- Futures: In this type of trading, you buy or sell a contract on an index for a future delivery date at a pre-set price.

- Exchange Traded Funds (ETFs): They trade like individual stocks. They provide exposure to the performance of the underlying index.

- Contracts for Difference (CFDs): Traders can use CFDs to speculate on changes in the price of an index without actually holding the underlying security.

02. Opening an Index Trading Account

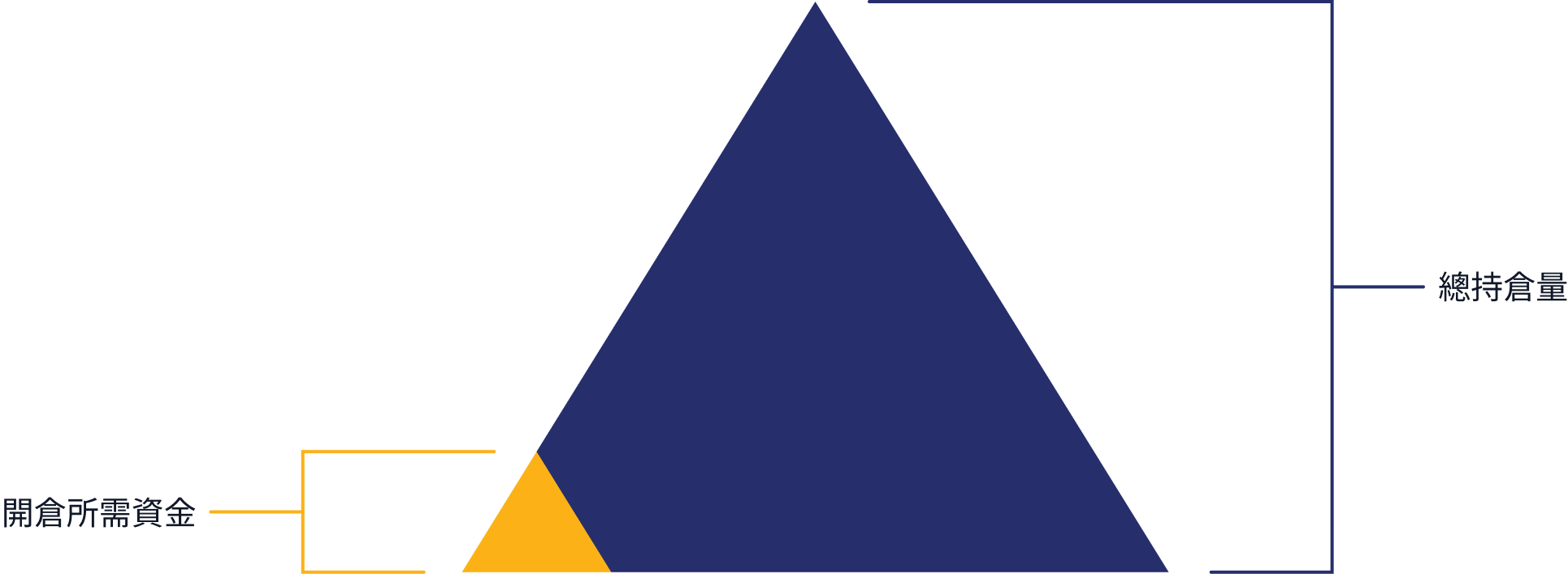

Once you've determined the type of index trading you prefer, you'll need to open an account with a trusted and regulated broker who can offer you other advantages such as high leverage and tight spreads.

03. Choose which indexes you want to trade

It is important to choose an index that matches your trading style. This will depend on your personal risk tolerance, the capital you have on hand, and whether you prefer to take short-term or long-term positions.

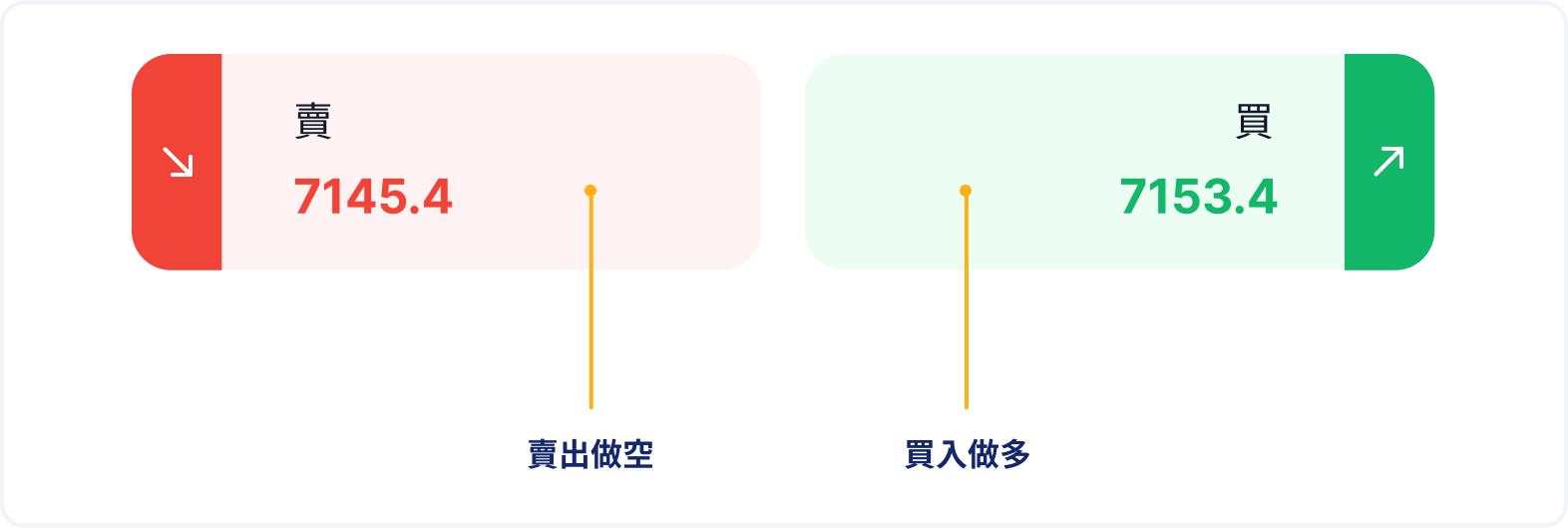

04. Deciding whether to go long or short when trading an index

If you find that a company in an index is doing well, you can open a long position and realize a profit if the value of the index goes up. On the other hand, you can open a short position if the index does not perform well.

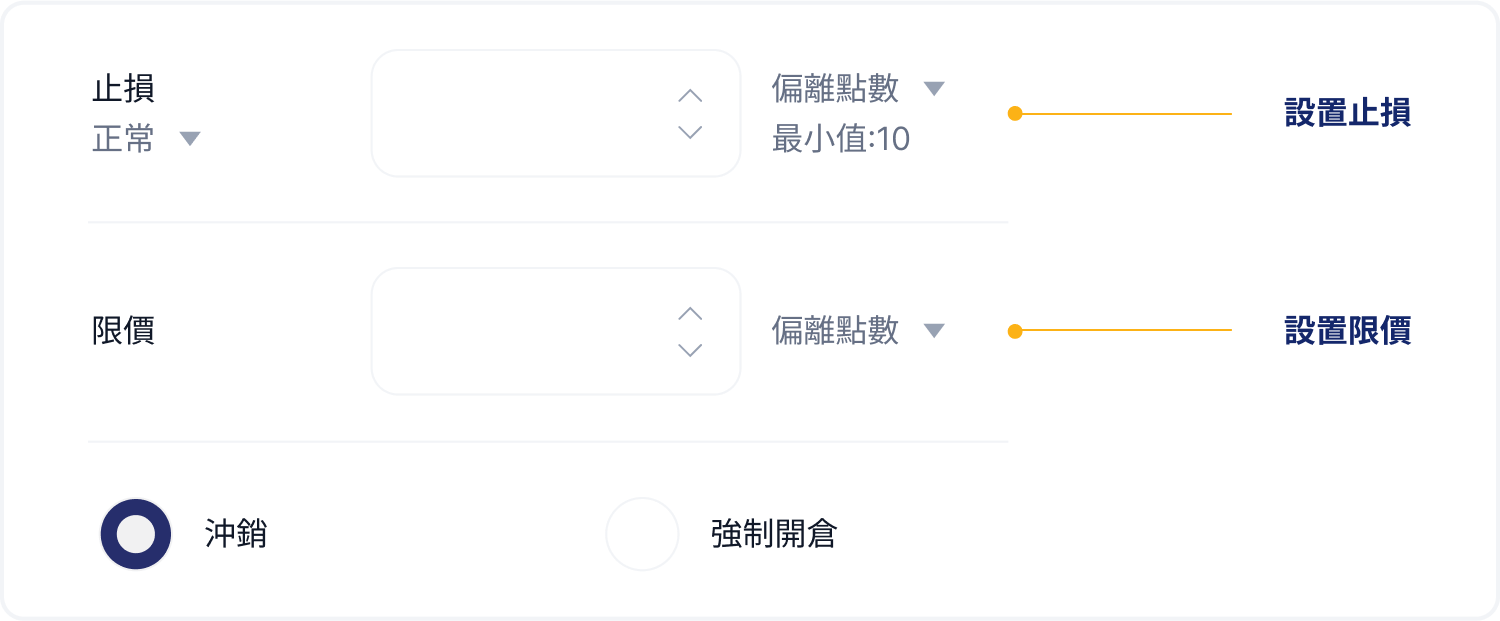

05. Setting your stop and limit orders

Stop and limit orders are very important tools for managing trading risk. With a stop loss order, your position will automatically close when it reaches a price that is unfavorable to the current market price. Limit orders will close your position when it reaches a more favorable price.

What are the risks involved in trading Indexes?

Like any other type of trading and investing, trading Indexes involves certain risks that traders should be aware of. The performance of an index can be greatly influenced by the performance of the market, especially when the market becomes highly volatile. After all, an index consists of the stocks of several companies, and changes in the performance of one of those companies will affect the index. In addition, Indexes are susceptible to currency risk, which means that changes in exchange rates may affect the value of the index. Another major risk to be aware of is gaps or sharp fluctuations in the value of the index. In conclusion, it is important to set up a risk management strategy when investing in stocks.