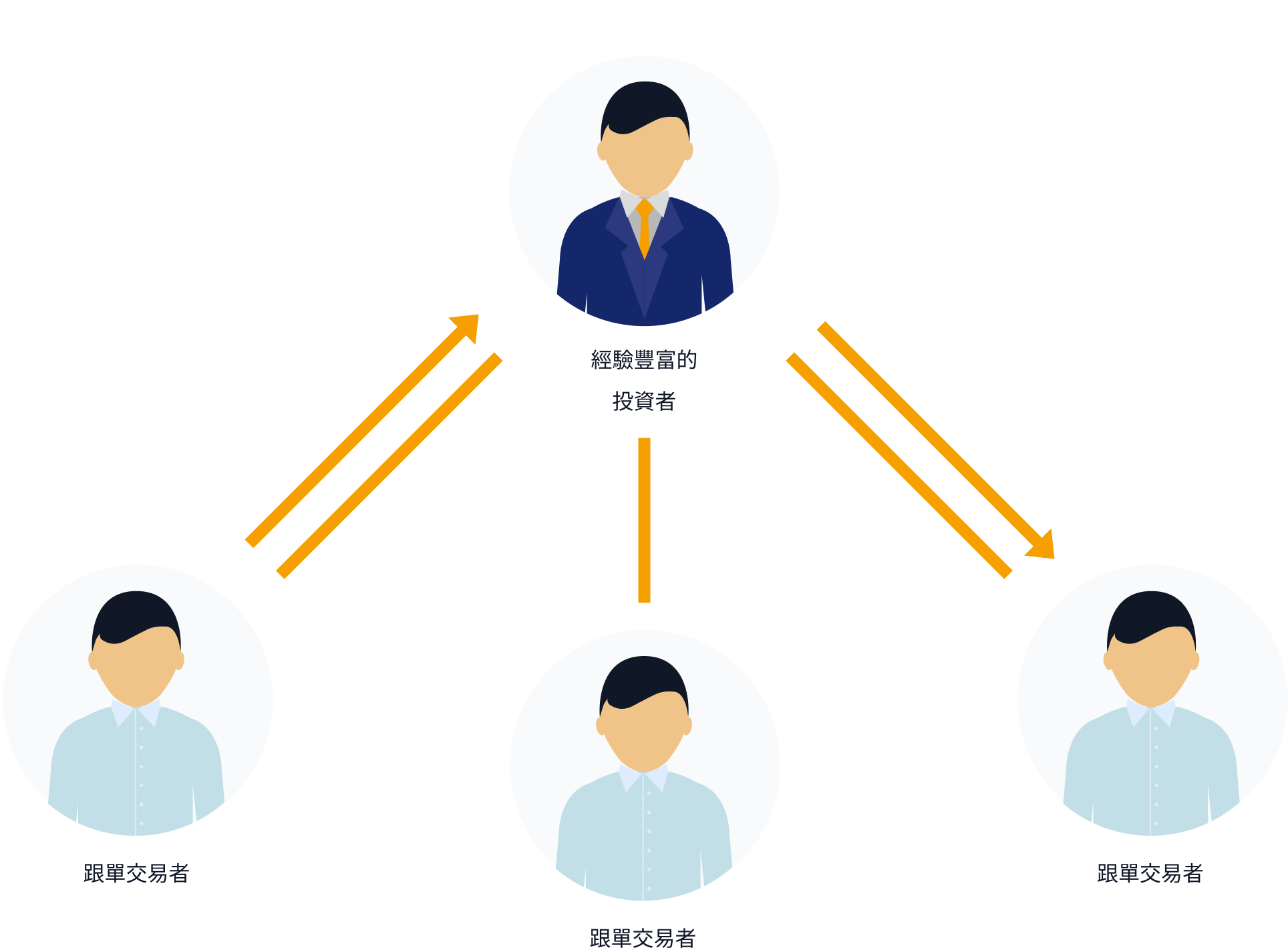

A common question traders ask is what is copy trade? What are the benefits and risks? Order following is a tool that can save a lot of time and potentially increase your profits. For some, investing requires a lot of research and effort. You need to understand market performance and learn how to read fundamental and technical analysis to be able to determine the best trades. With trading, you don't have to go through the hassle of this long process. You just need to find successful investors and start copying their trades.

As is obvious, trading with a broker is an easy and seamless way to enter the world of investing. After you open an account on the platform and choose to become a follower, you can search for providers and your job is done. However, trading with a follower comes with its own set of benefits and risks.

How do I copy a trade?

Copy trade is probably the easiest way to get started in the world of investing. There are a few steps you need to learn and follow to take advantage of the benefits and avoid the risks of order following.

01. Research to choose the best trading platform for order following

Before you start copy trade with a broker, you need to choose a platform that you can trust. You can check the platform reviews provided by different brokers and decide on the best platform to use.

02. Finding the Best Follower

Your research is not just about finding the best platform. It's time to find the best investor or provider to follow. Most platforms offer the opportunity to see and compare the performance of different traders and then start following the ones that are performing well. When choosing an investor, remember to choose someone who has a proven track record of success and a consistent trading strategy.

03. Set a risk tolerance level

Determining how much you are willing to risk on each trade is an important step when starting any investment. It is important to set a level of risk that you are comfortable with and that fits your financial goals, investment cycle and personal situation. Once you have determined your risk level, it is important to stick to it. Doing so will help you avoid making emotional decisions and ensure that your trading strategy remains consistent.

04. Start monitoring your trades

While following trades can be a useful shortcut to successful trading, it is still important to keep monitoring your trades. It is important that you keep abreast of any market conditions that may affect your assets. In addition, checking the balance of your account is vital as it will help you assess how well your trades are performing.

05. Learn from your trading experience

Copy trade can save you a lot of hard work in the investment game. However, it provides a great opportunity to learn. By monitoring your trades, you can determine which methods work well and which ones don't. This allows you to adjust your trading accordingly. This allows you to adjust your trading strategy accordingly and increase your chances of success.

What are the benefits of copy trade?

Saving energy is not the only benefit of copy trade. In fact, order following offers a wide range of advantages to its users, including:

01. Saving time with copy trade

As mentioned earlier, you don't need to be an expert market analyst or have an in-depth knowledge of the market to start order-following. Instead, you can focus on following successful investors, which saves you time and energy.

02. It provides flexibility

Copy trade not only gives you the opportunity to choose the best performing traders, it also gives you the freedom to decide how much you want to invest in each trade. This flexibility is an important advantage of order following as it allows you to adjust your investment strategy according to your risk tolerance and financial goals.

03. Minimizes risk with copy trade

An important advantage of copy trade is that you can easily diversify your portfolio. By copying different investors and investing in different assets, you can achieve a well-diversified portfolio that minimizes trading risk and maximizes returns.

What are the risks involved in order following trading?

Although order-following can offer many benefits to its users, it also comes with its own set of risks. Some of the main risks include:

01. Potential Losses

Copy trade allows you to follow successful investors in the market. However, it is important to remember that the traders you follow can sometimes fail. If market conditions change, the risk of potential losses increases.

02. Limited control over trading

You do not have complete control over your trading. While you can adjust the amount you invest and your risk tolerance level, the final decision to execute a trade is not yours to make.

How can I reduce my risk?

There are a number of steps you can take to reduce the risk associated with the instrument. First, select the traders you want to follow, choosing those with good performance records and low risk scores. Second, diversify your portfolio by following different traders who invest in a variety of assets and markets. Third, pay close attention to executed trades and adjust your risk tolerance level accordingly. Consider using stop-loss features to limit potential losses. Finally, monitor and review the performance of your chosen traders on a regular basis and be prepared to make changes to your portfolio if necessary.