CFDs (Contracts for Difference) are a type of derivative. These contracts allow you to speculate on financial markets such as stocks, currencies, Indexes and commodities without holding the underlying asset. Let's take a closer look.

As they are contracts, contractual spreads - like any other contract - should have two parties who agree to certain conditions. The two parties included in such contracts are the individual investor and the investment bank or company. The agreement between these two parties is to exchange the difference between the opening and closing prices of a particular financial item.

In fact, CFDs are one of the most popular and innovative investment tools because these contracts allow you to trade the price movements of any asset class, such as stocks, Indexes, commodities, forex, metals, without the need to own the underlying financial instrument.

How do I trade CFDs?

Generally speaking, there are six steps to follow when trading CFDs. First, you need to understand how these contracts work. After that, you can open a trading account with a trusted broker and fund it. Next, you need to create a trading plan to help you find trading opportunities. Then, you will need to search for trading platforms to open, monitor and close your positions. More detailed information on each of these steps can be found below:

01. Understanding how CFDs work

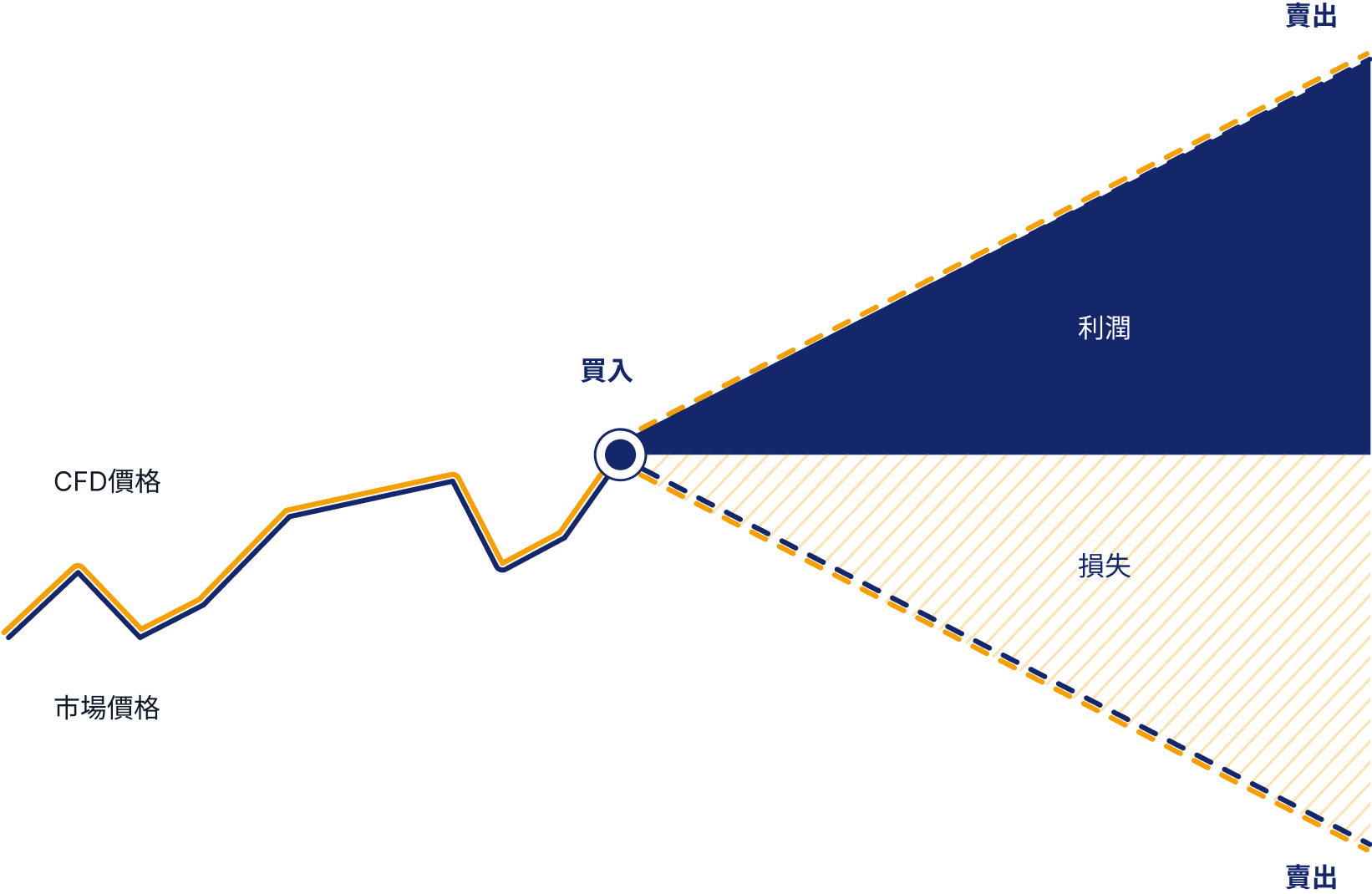

The working mechanism of CFDs has already been clarified in the introduction. However, let's simplify and explain it in more detail. CFDs are contracts that allow you to trade assets without owning them. With CFDs, you first open a position and then close it through a reverse trade with the CFD provider. If the opening position is a sell (short), the closing position is a buy (long), and vice versa. If the opening position is a buy, the closing position is a sell. The difference between the two trades is the trader's net profit.

02. Opening a Trading Account with a Trusted Broker

Now that you know a little bit about CFDs, it's time to get down to business. First, you'll need to find a broker you trust, one that is highly regulated and offers you other advantages such as high leverage and tight spreads. Once you've chosen your broker, follow the steps required to open a trading account and fund it.

03. Create a Trading Plan

Whenever you're under pressure, you'll realize how valuable the time you spend creating a trading plan is. A trading plan serves as a reference for the type of trading you want to do, the profits you expect to make, the losses you are comfortable with, and how you will manage your risk.

04. Finding the right trading opportunities for you

One of the biggest benefits of having a trading plan is that it can help you find trading opportunities that are right for you. It's often difficult to decide what your first trade should be because you have so many options to choose from, such as stocks, commodities. Therefore, you need to utilize all the tools and resources available to you to make an informed decision about your first trade or subsequent trades.

05. Search for Online Trading Platforms

You can choose from a variety of platforms offered by brokers. These include MT4 and MT5 platforms as well as web-based platforms that allow you to trade without having to download any software.

06. Open, monitor and close your positions

Now is the time for real action. Now on your trading platform you can start opening positions. When opening a position, you will need to select the asset you are trading, the position size, the stop loss/profit target and other trading parameters. Once the position is opened, you can monitor the performance of your position by monitoring the market movements. If the market moves in the direction you expect, you can choose to close your position when your profit target is reached. On the other hand, if the market moves against you, you can choose to close your position when you reach your stop loss target to minimize your losses.

Advantages of trading CFDs

Trading CFDs (Contracts for Difference) has a number of advantages over traditional investments. Here are some of them:

01. Profit in a falling market

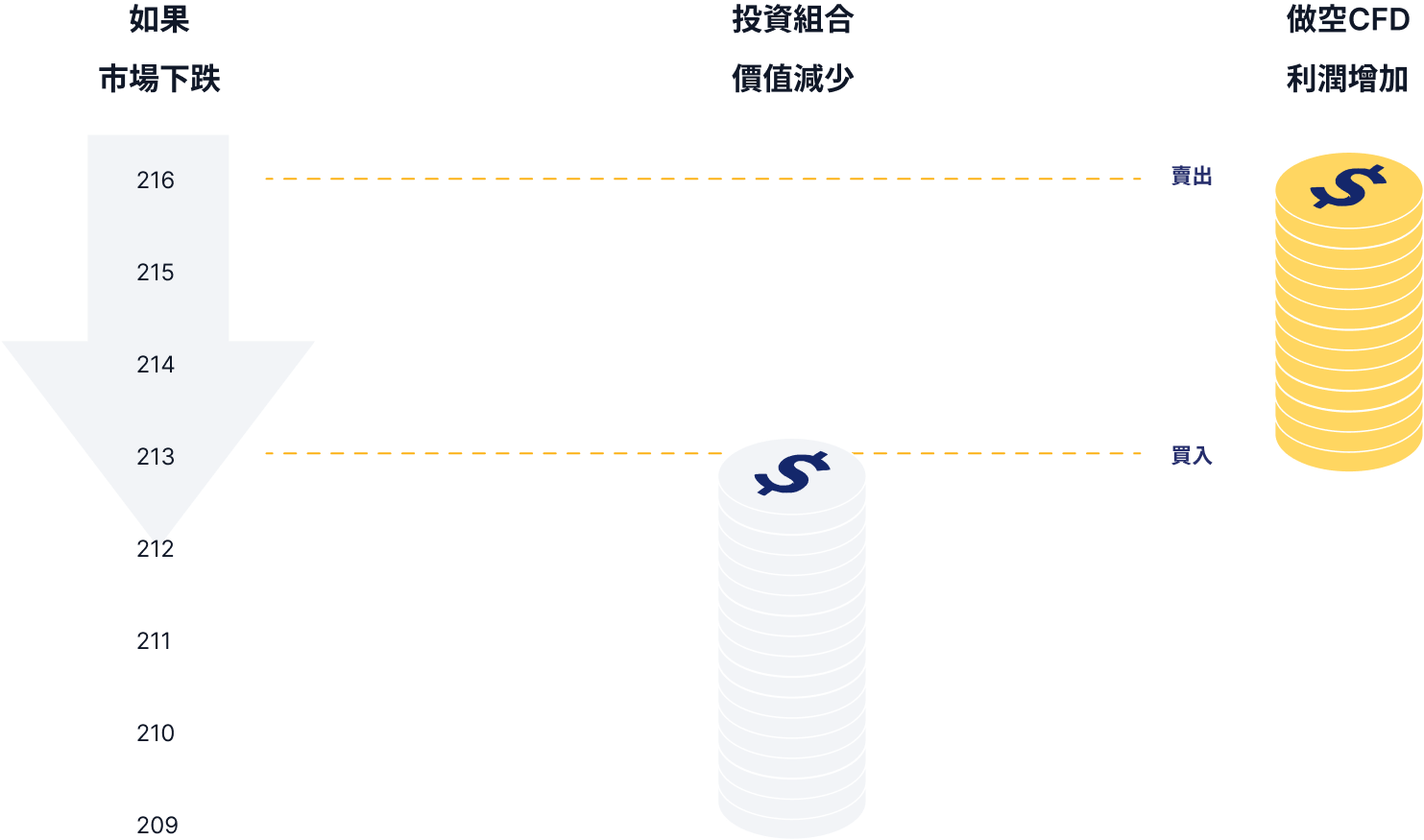

In traditional investing, you can only profit when the price of the shares of the company you buy goes up. This is not the case with CFDs. Contractual spreads give you the opportunity to profit even if the price goes down, because you can short or sell CFDs if you think the price will go down, as we mentioned before. This is easy to do with CFDs as you don't own the underlying asset.

02. Invest in a wide range of asset classes anytime, anywhere

You can trade CFDs on a wide range of asset classes such as equities, Indexes, forex, commodities and metals anytime, anywhere, on any device, either by downloading the platform or by simply logging in using the web-based trading. You can log in to your device or trading platform at any time and even trade some markets outside of trading hours. This is what we call "off-hours trading".

03. Trading with leverage

A leverage is like a loan you get from your forex broker to trade the market with a small initial deposit. In other words, you pay part of the amount and borrow the rest from your forex broker. This makes trading CFDs more cost effective than other investment options. Using leverage, you can increase the amount of currency in which you hold a position in order to increase the possible gains and increase the return on your investment, but it is important to recognize that losses will also be magnified and you may lose more than your initial deposit. However, this is explained in further detail in the Shortfalls section.

04. Gaining greater liquidity

The pricing of CFDs directly reflects the underlying market. This means that in addition to the liquidity provided by the CFD broker, CFDs provide you with access to the liquidity of the underlying market.

Weaknesses of trading CFDs (Contract for Difference)

There are some risks associated with trading CFDs and you should be aware of these risks when trading. Here are some of the risks:

01. Trading with leverage

It may sound strange that one of the benefits we mentioned earlier is now the first disadvantage we list in this section. In fact, it is important to emphasize the risks associated with trading with levers and show that it can be a double-edged sword. Even small price fluctuations can, in some cases, wipe out a trader's entire investment. This is why we cannot overemphasize the importance of having a solid risk management strategy for trading.

02. Overtrading

Overtrading is the practice of buying and selling too much of an asset. There are also risks associated with this practice. Since CFDs are open to retail investors with zero starting costs, some people are tempted to over-trade. Overtrading can result in a trader having insufficient capital left to cover the potential losses of all open positions. Therefore, when trading CFDs, it is important that investors manage their open positions correctly.

03. Increased CFD Trading Costs

For long-term investors, the costs of CFD trading can add up over time if not handled correctly. In addition to the typical spread or commission fees, investors who intend to open long-term trades should be aware of additional costs, such as overnight fees for holding positions overnight. For the best results, consider all possible costs before you start trading.

Now that you understand what CFDs are, you have an idea of how to trade them. While these contracts may have their drawbacks, they can still be very profitable if you know how to manage the risks involved, have a good plan, and continue to learn and educate yourself.